How to Avoid a Bear Trap

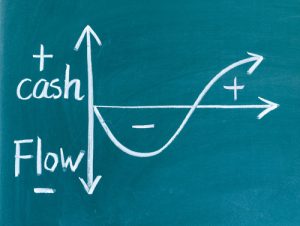

Do your clients pay before you’ve completed the project? If not, how long do you typically wait to be paid? Does cash leave faster than it comes in because your business is growing? Do you worry about making payroll? Do you delay kicking off the next project while waiting to be paid for the last one? My friend Brett Haigler calls these cash gaps “bear traps,” and he’s on a mission to help business owners avoid them.

Brett is a founder of InBank – a bank new to the Denver market that Brett jokingly calls a “100-year-old start-up.” Brett and his partners bought International Bank, a 100-year-old New Mexico bank, and by applying the latest technology transformed it into a business-friendly bank. Brett has also run other businesses and comes from a family of entrepreneurs, so he’s familiar with the difficulties and struggles business owners face and knows the stresses they endure.

This familiarity and empathy contributed much to InBank’s development of its “Business Manager” product. “Good businesses get into trouble,” Brett says, “not because of lack of sales or bad money management, but because as they grow  they close so many sales that they don’t have enough cash to handle the increased expenses that those sales generate.”

they close so many sales that they don’t have enough cash to handle the increased expenses that those sales generate.”

The Business Manager product lets the client sell a receivable to InBank and convert about 90% of the face amount to cash. InBank holds about 10% of the face amount in a reserve account. The bank’s fee is based on when the invoice is paid, and when it’s paid InBank deducts its fee from the reserve. The process is powered by technology. Specialized software automates and manages the program, making it more efficient for the client and for InBank. Since InBank controls the process, it can control costs and minimize the cost to the client. The software also provides analytics to the client and the bank.

Most working capital lines of credit make the borrower (you) “rest,” or pay down the outstanding balance every year. Business Manager does not require these “rest” periods or paydowns. This is important if your business is seasonal or is growing, or both.

Business Manager also lets the client avoid showing increasing debt on its balance sheet. This is because the Business Manager client is selling its accounts receivable (an asset) in exchange for cash (another asset). The balance sheets of the client using Business Manager show changes between these two asset classes instead of an increase in debt.

For many clients, Business Manager offers more customization and options than most other bank offerings. In one case, a community bank terminated its long-term customer’s traditional $150K line of credit because the client was regularly using the entire line of credit and the outstanding balance was consistently at or near the credit limit. The client also failed to “rest” (pay down the balance) for more than a year. The community bank converted the line of credit to a permanent term loan. Following the conversion, the client had to turn business away because it lacked the cash it needed to fund new projects between the projects’ kick-off and receipt of the customer’s payment.

Brett stepped in and gave this client a $300K Business Manager line of credit. The client used the new financing to fund profitable growth. After three years, the client, working with Brett, has increased the Business Manager line of credit to $650K, continues to grow profitably, and has created several new jobs.

InBank functions like a small bank, but with a lending limit of $15 million it can lend like a big bank, and Brett is a certified commercial lender. “Personal service enhanced by technology” is how Brett describes InBank’s offerings. All the  lenders at InBank are commercial banking veterans, and most have twenty-five years or more of experience.

lenders at InBank are commercial banking veterans, and most have twenty-five years or more of experience.

While the Business Manager product is unique and Brett is particularly passionate about it, InBank offers all the other loan products of a traditional commercial bank, such as SBA-guaranteed loans, construction loans, commercial mortgages, and traditional lines of credit.

Brett and InBank also help the bank’s clients manage cash flow with treasury management services such as online banking, sweep services, remote transfers, purchase cards, and merchant services. “Many businesses don’t need to borrow money,” Brett observes, “they just need to manage it efficiently. That is where InBank’s technology can really make a difference.” InBank’s application of technology is also geared to achieve the bank’s institutional goal to eliminate the need for a client to travel to the bank.

Brett’s favorite projects involve trusting relationships in which Brett and the client learn from each other. He loves working on multiple deals with the same client. He says that “efficiency and certainty are enhanced with repeat customers.” “It’s not a volume game for me,” he says. He loves to see clients succeed and avoid bear traps and create jobs.

If you’re interested in getting to know Brett or learning more about InBank, please reach out to me. I’d be honored to connect you.