What Might We Anticipate Coming Out of the COVID Tunnel?

We here at Steven M. Bush, a Professional Corporation, hope that our friends, colleagues, and clients and your families have been spared being infected with the COVID-19 virus. I anticipate that, like me, you haven’t experienced any symptoms of the virus but you’re sick of the effect the pandemic has had on us all. Perhaps  we can start imagining a world without shelter-in-place orders, face masks, and fear for our health.

we can start imagining a world without shelter-in-place orders, face masks, and fear for our health.

If you and your business colleagues haven’t already done so, I urge you to use this time to re-think, re-imagine, and re-evaluate. What projects have you put on hold and it’s now time to complete? Is your company permanently and reliably set up for remote work and are you supporting that model effectively? Might you need to restructure your operations or balance sheet? Might you be considering a purchase? Did you experience staffing cutbacks, and if so, will you re-staff your teams the same as before?

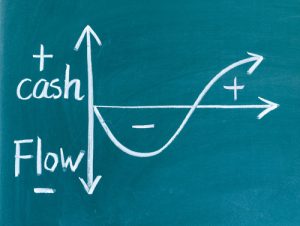

All this re-thinking, imagining, and evaluating will probably include some cash-flow forecasting that might strain your existing processes and personnel. If you can also de-risk your business and become more agile, all the better – but who will help keep all those plates spinning atop each stick? Might you have a gap in your operations and, if so, how might you fill it? Might some tasks get rushed or left undone for lack of bandwidth or resources?

My friend Karen Breen has recently “Embark-ed” on a new adventure working with a team of former “Big 4” CPAs who work alongside CFOs and their teams to move-the-needle on key projects. Karen is the Managing Director at Embark, an accounting and finance advisory firm that solves problems for CFOs and their teams. Embark was founded in 2010 and expanded to Colorado from its Dallas home base just two years ago. Karen and Embark work with companies of all kinds and sizes and offer support in a myriad of areas, from implementing new and complex accounting rules to assisting with quality of earnings analyses, ERP system implementations, audit/IPO readiness, to filling critical-role vacancies from staff accountant to controller.

Especially now, companies are rethinking business models and relying more on on-demand talent such as Embark offers to complete critical projects for which  the company might not have the staff, expertise, or desire to tackle on their own. Companies in hyper-growth mode, for example, are often challenged to recruit, train, and build effective accounting teams that can keep up with the company’s needs. These teams are also usually challenged to keep up with changing reporting standards and the company’s growth. For clients like this, Embark creates processes to allow and ensure that the company can properly close its books on time.

the company might not have the staff, expertise, or desire to tackle on their own. Companies in hyper-growth mode, for example, are often challenged to recruit, train, and build effective accounting teams that can keep up with the company’s needs. These teams are also usually challenged to keep up with changing reporting standards and the company’s growth. For clients like this, Embark creates processes to allow and ensure that the company can properly close its books on time.

What if you’re comfortably handling day-to-day operations but might be over-burdened by a special project, such as a purchase transaction or public offering? Karen shared that these are her favorite projects because they’re dynamic and each is unique. For example, Karen’s team recently consulted with TGIF Friday’s on their plans to go public and with Ping Identity on implementing a new accounting standard.

Embark is small and nimble but leverages big league talent and experience. All of Embark’s consultants started their careers with a “Big 4” accounting firm, and  most have additional publicly traded company experience. These consultants offer their clients a high-level of service at a lower cost when compared to other consulting firms. Karen said, “We provide the right talent, for the right need, at the right time.” Sounds to me like Karen also has marketing skills!

most have additional publicly traded company experience. These consultants offer their clients a high-level of service at a lower cost when compared to other consulting firms. Karen said, “We provide the right talent, for the right need, at the right time.” Sounds to me like Karen also has marketing skills!

Like most financial consulting firms, Embark is equipped to put month-end closing processes in place, to ensure that newly acquired target companies are presenting financial information accurately, and to expand and update accounting procedures to fit growing businesses and ever-changing standards.

Have you stayed awake at night worrying what would happen if a key member of your team suddenly left? Sleep easy! Emergency and temporary staffing for critical functions are in Embark’s wheelhouse. Financing or restructuring issues causing your heartburn? Embark helps clients prepare financial statements that fairly and accurately present the company’s performance and conform with current accounting standards. PPP loan or loan forgiveness application? Sarbanes-Oxley compliance? Facing an audit? Embark has the “plug-and-play” expertise to get the job done.

Karen’s clients tell her that their relationship with Embark is mission critical. When the client lacks the time, resources, or expertise needed, they turn to Embark for needed bandwidth and support. Karen reported that about 30% of her team’s work is on an “emergency” basis – doing or fixing something immediately, when delay means serious consequences. If you have a need, project, staffing gap, or task in the realm of accounting or finance, Embark can help.

Embark is constantly recruiting – not just clients, but talent as well. Their stable usually includes a consultant who has the right skill set to meet the client’s particular need in real time. Karen shared that she most enjoys the variety and diversity of clients and challenges she and her Embark team take on and the smart and versatile people with whom she is blessed to work. Karen recommends when evaluating finance consultants to look for someone with a solid technical accounting foundation and high emotional IQ – someone who is attentive and looks for other opportunities to help.

If you’re interested in hearing more from Karen or think Embark may be able to help you in your business, please reach out to me. I’d be honored to connect you.

the right insurance for you and your family? When I’ve had these questions myself, I turned to my friend Tierney Aldridge at narrative™ by Denver Agency for answers and sound advice.

the right insurance for you and your family? When I’ve had these questions myself, I turned to my friend Tierney Aldridge at narrative™ by Denver Agency for answers and sound advice. uncertainty and doubt about how the policy will respond in various loss scenarios. As part of their review, Tierney and her team analyze their findings and present them in a clear, simple and yet sophisticated way. Tierney tells me that these reviews often include discussions about self-insurance, increasing deductibles, and the risk benefits of using premium savings to increase liability limits. After the review has been completed and the policies put in place, Tierney and her team continue to provide continuous service and counsel to maintain the integrity and stability of the program.

uncertainty and doubt about how the policy will respond in various loss scenarios. As part of their review, Tierney and her team analyze their findings and present them in a clear, simple and yet sophisticated way. Tierney tells me that these reviews often include discussions about self-insurance, increasing deductibles, and the risk benefits of using premium savings to increase liability limits. After the review has been completed and the policies put in place, Tierney and her team continue to provide continuous service and counsel to maintain the integrity and stability of the program. commercial liability exposure from real estate or other investments. Tierney has the background and team at Denver Agency to solve for both personal and business insurance needs.

commercial liability exposure from real estate or other investments. Tierney has the background and team at Denver Agency to solve for both personal and business insurance needs. in trouble,” “I’m working too hard,” “I’m not having fun,” and “This business is my retirement, but the value is shrinking.”

in trouble,” “I’m working too hard,” “I’m not having fun,” and “This business is my retirement, but the value is shrinking.” shared that his coaching sessions tend to combine business and personal problems and solutions. “It’s all intertwined,” he says. “I’m able to bring a balanced perspective.”

shared that his coaching sessions tend to combine business and personal problems and solutions. “It’s all intertwined,” he says. “I’m able to bring a balanced perspective.” allow for the growth or goals you have in mind. Mike works with owners and their leadership teams to intentionally transform culture by creating clarity around the owner’s goals. Mike helps the owner and team members answer the questions “Who are we?” “Why do we exist?” “How do we behave?” and “How will we succeed?” Answers to these questions also help Mike and the client build cohesive leadership teams. This work takes courage and discipline, and it requires the client be committed to the process. For most clients, the journey to transformative cultural change has no end point but the initial investment takes 18 to 24 months.

allow for the growth or goals you have in mind. Mike works with owners and their leadership teams to intentionally transform culture by creating clarity around the owner’s goals. Mike helps the owner and team members answer the questions “Who are we?” “Why do we exist?” “How do we behave?” and “How will we succeed?” Answers to these questions also help Mike and the client build cohesive leadership teams. This work takes courage and discipline, and it requires the client be committed to the process. For most clients, the journey to transformative cultural change has no end point but the initial investment takes 18 to 24 months. the immediate needs and create flexibility to continue to meet the client’s needs and goals as they change and evolve.

the immediate needs and create flexibility to continue to meet the client’s needs and goals as they change and evolve. case, a building materials company renewed its existing lease but quickly expanded its needs when it bought the business of its installation contractor. Jason and his team helped the client identify an unrecognized need for warehouse space. Based on Jason’s consultation, the client combined all its diverse operations in a single location. This solution expanded the client’s space in all the places where more space was needed, facilitated immediate growth, increased the management and employee efficiency, saved a lot of money, and had built-in flexibility to accommodate additional growth.

case, a building materials company renewed its existing lease but quickly expanded its needs when it bought the business of its installation contractor. Jason and his team helped the client identify an unrecognized need for warehouse space. Based on Jason’s consultation, the client combined all its diverse operations in a single location. This solution expanded the client’s space in all the places where more space was needed, facilitated immediate growth, increased the management and employee efficiency, saved a lot of money, and had built-in flexibility to accommodate additional growth. would want to work with a broker who is as interested in building our relationship as I am.” He would also look for a broker who is consultative, with the right combination of skills, network, and influence to complement you and your team. “Sometimes influence is what it takes to move the needle,” says Jason. “You’ve got to like and respect who you’re working with and trust that they’re going to use all their abilities and professionalism to get the results that you want.”

would want to work with a broker who is as interested in building our relationship as I am.” He would also look for a broker who is consultative, with the right combination of skills, network, and influence to complement you and your team. “Sometimes influence is what it takes to move the needle,” says Jason. “You’ve got to like and respect who you’re working with and trust that they’re going to use all their abilities and professionalism to get the results that you want.” they close so many sales that they don’t have enough cash to handle the increased expenses that those sales generate.”

they close so many sales that they don’t have enough cash to handle the increased expenses that those sales generate.” lenders at InBank are commercial banking veterans, and most have twenty-five years or more of experience.

lenders at InBank are commercial banking veterans, and most have twenty-five years or more of experience.